19 Easy and Creative Ways to Save Money for Travel

This site contains affiliate links to products or services that I recommend. Any purchases made through these links don’t add anything to your purchase price. It helps me keep the lights on and bring you quality travel tips. As an Amazon Associate, I earn from qualifying purchases. Thanks so much for your support!

Aren’t we all looking for creative ways to save money? Whether it’s for travel, splurges, buying big-ticket items, or maybe even just paying the bills each month. Did you know that there are sources out there where you can find creative ways to save money and even find lost money that you may not have realized you had available? I’ll share the secrets for finding lost money in a separate post very soon so be sure to sign up for my mailing list here.

Maybe you don’t have enough “disposable” income to pay for your next road trip. Or maybe you have a hard time saving for long-term goals. Here’s where you can find creative ways to save money in unexpected places that can add up quickly.

1. Shop Weekly Grocery Store Sales

This may seem like an old-school method from your grandmother’s era but it’s still a creative way to save money every time you shop for groceries. One of the primary ways to save money at the grocery store is to plan your meals around what foods are on sale that week. It takes some planning but is well worth the time and money, especially if you’re on a budget.

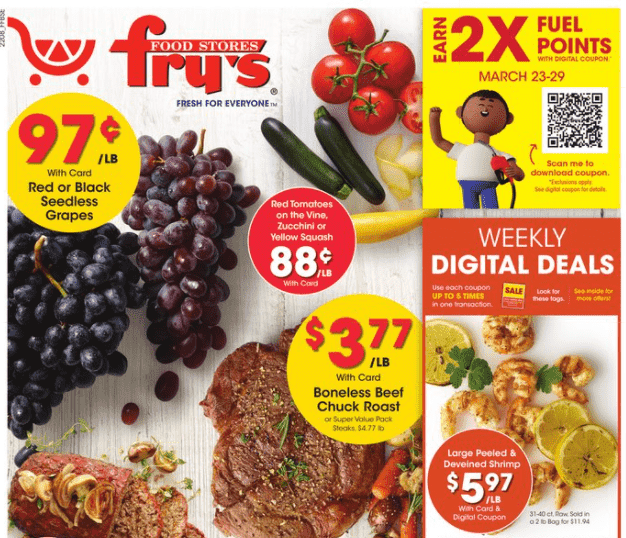

Did you know that nearly every grocery store publishes a multi-page weekly ad? They usually come out on Wednesdays or Thursdays. Even if you don’t get a printed newspaper you can find the weekly sale ads online by searching for your favorite [grocery store name] “weekly ad”. When I was a young wife on a tight budget, I would look at the ads for several different stores in case there was a great sale that wasn’t at my favorite store.

Shopping at more than one store does take extra time and isn’t always worth it. That’s why grocery stores advertise sales every week. They know that most people who come in do all their shopping at one store. So if they can get you in the door with a sale, you’ll likely buy everything else there too.

Some of the biggest discounted items (like turkeys at Thanksgiving) are even loss leaders. That means they’re selling the item at little or no profit for the store just to get you in there. They know that they’ll make up the difference (and then some) on the rest of your big shopping for the holiday/week.

2. Make a Grocery Shopping List and Stick To It

This creative way to save money is very important because you do it so often throughout the year. Before you go to the grocery store (or shop online), make a shopping list.

- Some people keep an ongoing list on paper (or in a list app on their phone) and add items as they run out of them at home. Some list apps like “AnyList” have the ability to share lists between multiple parties. That way your kids or partner can add items to the list when they notice they’re needed. This saves you from having to go to the store more often for missed or forgotten items.

- Even if you don’t have an ongoing list, take a few minutes to write down (or enter in your list app) everything that you know you need before you go to the store.

- The next important step is to check the weekly grocery store ad. Hint: Usually the items on the top half of page 1 are the most discounted.

- If one of my needed items is on sale, I indicate it on my list with an asterisk or star and I write down the sale price. That way I know to look for that price and ask someone if I don’t see it.

- While you’re looking at the grocery ad, see what main dish items have the best sales. For example, in the ad above, beef roast is on sale. That can be used for many different meals, like traditional roast, beef stew, stroganoff, BBQ beef sandwiches, French Dip sandwiches, enchiladas, chili, and more. It’s easy to cook one or two roasts and have enough for several meals.

- As you come up with ideas for meals, write them down somewhere. Then make sure you have the other ingredients you need as well. If you don’t, then add them to your list.

- If you have freezer space you can buy extra items when there’s a good sale too. That way you don’t have to eat the same meat the whole week. You can buy 2 or 3 beef roasts and freeze two for later.

- [If you’re feeding a family I highly recommend buying a stand-alone freezer for this very reason. It will save you hundreds, if not thousands of dollars in the long run. I still keep my separate freezer stocked and there are just two of us in the house now. It saves me from having to go shopping as often and I love having a variety of foods on hand.]

- You’ll also see in the grocery ad above that grapes, tomatoes, zucchini and yellow squash are all on sale. You may know that normally grapes and tomatoes can be $2.99 a pound or more, so these are great prices. In addition to using grapes for snacks and lunches you can also make things like chicken salad or waldorf salad. And the squash and tomatoes are excellent for Italian dishes and much more.

- When you see an item on sale and you’re not sure what to do with it, just do a quick search of recipes online using that particular item and you’ll find many creative ideas. It’s also a wonderful way to expand your food horizons and introduce your family to new flavors.

- Continue looking through the grocery store ad. Make note of any other items that have discounted prices that you can use that week or in the future. Remember that some items last a long time, like (non-perishables) canned goods, soups, dry goods like pasta, spices, etc. Even frozen foods keep quite a while. So stock up on those when they’re on sale too. This is another way that the extra freezer comes in handy.

- If you check the grocery store ads regularly you’ll get to the point where you have a pretty good idea of what price is good for items you buy regularly. When you know prices you won’t be as tempted to buy products at full price. By stocking up when things are on sale you’ll still have a variety of food options no matter what time of year it is.

3. Clip Grocery Store and Product Coupons

You can also look for coupons to save money on other things that you’re already planning to buy. If you have the time, you can pick up or subscribe to the local Sunday newspaper. It usually has a bunch of printed food, restaurant, and other coupons inserted inside. Clipping and organizing printed coupons is a commitment, but a decent amount of money can be saved if you’re serious about it. Especially when you can buy an item on sale plus use a coupon.

4. Use Digital Coupons to Save Money

You’ll also find a variety of digital coupons on your favorite grocery store app for more creative ways to save money. Some grocery stores even post signs with QR codes next to products. It’s easy to scan to get a digital coupon while you’re shopping, in case you missed it before.

Stores like Target and manufacturers like Proctor & Gamble offer coupons and discounts that can be credited, printed, or downloaded from their websites.

5. Eat Before You Go Shopping

This may sound strange, but be sure to have a meal before you go to the store. I can’t even count the number of times when I bought way too much extra food because I was hungry when I was shopping.

It seems pretty logical that you shouldn’t go to the grocery store on an empty stomach. But did you know that you shouldn’t do other shopping either? Even if you’re shopping for non-food items being hungry can subconsciously cause you to buy more. You can read more about the data here.

Creative Ways to Save Money While You’re in the Store

6. Shop with Special Store Discounts

Are you in the military, a senior citizen, or a student? If so, check to see if your local grocery store offers discounts for you. Many stores offer a senior discount one day each month. It usually falls in the first week of the month since that was once the time when all seniors received their social security checks. That timing has changed for new SS recipients, but there are still quite a few that get their checks in those first few days of the month, so the grocery stores want to entice them to shop at their store.

Nearly all grocery store chains offer their own VIP or discount card as well. It’s important to get the store card for anyplace that you shop regularly because you’ll save quite a bit of money each week with these. The good thing is that you don’t have to do much to get those discounts. Just swipe your VIP card when you go through the checkout line and the discounts will automatically come off your bill. You’ll notice that most of the sales in the weekly ads say that you only get the discounted price with their card.

Some grocery store cards even offer discounts on fuel for your car when you shop with their card. You can see that on the Fry’s weekly ad above. Those gasoline discounts really come in handy if you’re heading out on a road trip too.

7. Buy Only What’s on the Grocery List

Once you have your grocery list finished [and you’ve made sure that your belly is full] head to the store and do your best to only shop for the items on the list. I know it’s hard, but that’s where the list prep time helps immensely.

One way that I avoid buying items that aren’t on my list is by avoiding certain aisles altogether. I try to skip the aisles that are filled with candy, chips, desserts, sodas, etc. as much as possible since those foods are filled with empty calories and are usually pretty expensive. They don’t meet the criteria of a healthy diet and while I do allow myself treats I really try to keep it to a minimum. Out of sight, out of mind is my best plan of attack when I’m at the store.

8. Compare Prices When You’re in the Store

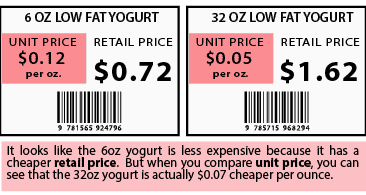

Another creative way to save money while you’re at the grocery store is to do price comparisons between all the different brands of each product. Grocery stores in America generally have an overwhelming amount of options for you to choose from as you walk the aisles. In general, the store brand is going to be your least expensive option. However, if a name-brand item is on sale, that might not be the case.

Your best bet is to compare the “unit pricing” that you see on the shelf tag. Labels like this help you compare the price per ounce, pound, etc. to see which one is really cheaper when products are of different sizes. Here’s a more detailed explanation of how it works.

Beware though. Sometimes the shelf labels aren’t really comparing apples to apples or ounces to ounces, so be sure to read all the fine print on the label.

9. Limit the Number of People Who Go Shopping

I also recommend shopping alone or with no more than one person along if you possibly can. When you have others with you, especially children, it’s hard to concentrate on the details of prices, quality, nutrition labels, etc. and it’s much easier for them to get you off track by asking (begging) you to buy treats or toys or whatever.

One exception to the one shopper rule is if your partner or teenager is a careful shopper too and is helpful in cutting down the time you’re there by taking half the list.

A good reason to include one of your children occasionally is to take some time to teach them how to shop or give them a chance to explore the world of food. When my kids were young I’d take them with me one at a time when possible. I’d let them pick out a new fruit, vegetable, or another food item to try that week (usually not candy or junk food).

We can all get in a rut and might forget that there are foods that our kids have never seen or tasted. Even if it’s something that you don’t like or have never tried, be open to buying new foods. You might be surprised by what you discover.

10. Be Sure You’re Going to Eat What You Buy

Another easy and creative way to save money that’s at the opposite end of the spectrum from stocking up on sale items is making sure that you eat everything you buy. Americans waste literally tons of food every year. If you buy large quantities of food on sale or at a big box store and it goes bad before you eat it, you’ve lost all the savings that you thought you had. You might as well be throwing money in the trash can.

A package of 5 dozen eggs isn’t worth it if they don’t fit in your refrigerator or they go bad before you can eat them all. On the other hand, if you have friends or family nearby you might save money by buying in larger quantities and sharing the cost and product with them.

11. Avoid Food Spoilage

Think about produce that spoils quickly too. If it can’t be frozen or stored longer in other ways, then it’s not worth it to buy extra when it’s on sale. I know it’s a delicate balance, especially if you live alone or there are just a few people in the house. It’s sometimes hard to eat everything before it goes bad. Avoiding food waste makes it even more important to think about how you’re going to use something while you’re writing your shopping list.

It’s also helpful to do some research on the best ways to store various foods to keep them fresh longer. For example, I was buying groceries for 40 years before I learned this trick for how to store parsley to keep it fresh for a month or more. I also just discovered a fun new way to keep extra citrus fruit like oranges and lemons. I’ll be sharing about that soon.

Eat Your Leftovers

OK, I know this is a tough one for some people and creates massive amounts of wasted food in the world. I think the key is to go back to that planning and list-making stage and think through how you’ll use an item for its first meal as well as how you can use it as leftovers if you don’t finish it in the first meal.

If we use the beef roast as an example. The first meal can be a traditional pot roast and the leftover meal can be a French Dip sandwich or even BBQ beef. Both are excellent meals and you get to use up the leftovers with the 2nd one.

It’s also helpful to take leftovers to work and reheat them to save money on lunches. Free vs $20 a day is a big cost saving.

12. Shop Seasonal Sales on Clothes and Household Goods

It’s also possible to save on bigger ticket items by waiting for sales. For example, mattress and furniture stores generally run sales on 3-day holiday weekends like Memorial Day and Labor Day. Seasonal items like patio furniture, holiday decorations, or snow gear are always on sale at the end of the season, so buy what you need for next year now and save money.

Looking for swimsuits or winter coats? You may be surprised that they start going on sale well before the end of the season to make room for the next season’s merchandise.

13. Search for Promo Codes & Cash Back Apps Online

When you shop for other items online always take a minute before you finish your order to do a quick search for promo codes that may lower the price. Open a new tab in your browser. Type in a search for the product name with the words “promo code” after the product name. It may take a few tries but you can often find money-saving codes to apply discounts to your order.

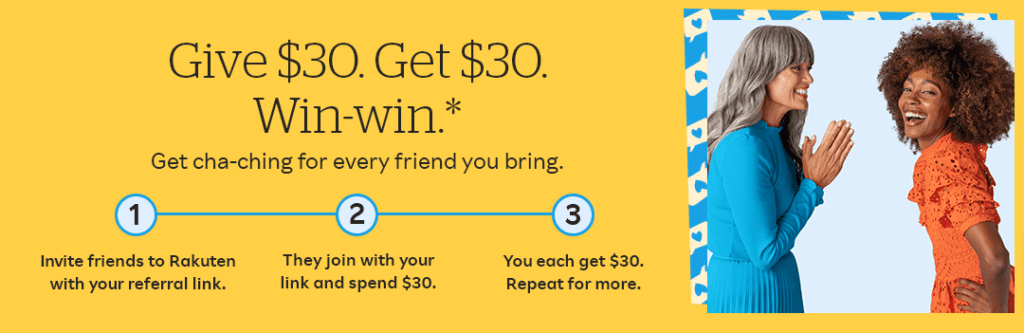

An easier way to find discounts online is with cash-back apps, like Rakuten and others. These apps find online discounts, promo codes, and rebates for you automatically when you’re shopping online for nearly everything.

14. Reward Yourself for Your Time Spent on Creative Ways to Save Money

Saving money takes time. The secret to making it enjoyable is that every time you save a few dollars, keep track of it. Then put that money into your savings jar or account to use for your next vacation or splurge. For example: if you go to the grocery store and the bottom of your receipt says you saved $20 with your coupons or rewards card, take $20 and move it to your savings account. If you save $150 on your next mattress at a big sale, move that money to your savings. You took the time to clip coupons and shop for sales. Be sure to pay yourself back for the time and effort you invested. You may be surprised at how motivating it is to see your savings account grow.

15. Eat and Drink at Home More

I know this one may be hard for some of you. Especially if you’re a daily coffee drinker and buy your morning beverage on the road. Or maybe you hate to (or don’t yet know how to) cook. But do the math on the difference between making food or drinks at home versus eating out. These creative ways to save money could literally add hundreds, if not thousands of dollars to your slush fund over the course of a year.

Let’s use coffee as an example. Even if you only buy a medium brewed coffee from your local coffee spot, it will add up. Coffee can cost at least $4.00 each time when you add tax and tip and most likely more. But for simplicity, let’s say $3.00 per day for 7 days a week. That’s $21 each week. If you only miss a few days each year, that’s still over $1,000 in ONE YEAR! That can pay for a nice getaway.

16. Cut Back on Eating Out a Few Meals Each Month

Now consider the cost of eating a meal at a restaurant. It likely costs a minimum of $15 to 20 per meal per person. Multiply that by the number of meals each year. Yikes! That’s a lot of money. It’s an easy and creative way to save money on your weekly expenses.

It’s also a win-win situation if you have kids at home that can learn and help with the cooking. I’ve personally been amazed at all the young 20-something women I’ve heard say that they don’t know how to cook. Taking time to teach your kids how to plan and prepare at least a few basic meals will be a benefit to them for the rest of their lives. It will also help them learn creative ways to save money themselves. With all the cooking shows and videos online there’s really no excuse not to learn to cook.

17. Make Changes a Little at a Time

Of course, I’m not saying that you can never eat out or buy a cup of joe again. Even cutting back by a few days a week or month will add quickly to your savings account. Your next adventure will be possible that much sooner. The key is to calculate what you’re spending each week now. Then put that saved money away when you cut back on going out.

18. Get the Kids Involved in Creative Ways to Save Money

If you’re planning a family road trip or vacation it’s great to get the kids involved in helping to save for it. It’s the perfect way for them to learn that money doesn’t grow on trees. They’ll realize that if they want something they have to sacrifice and work to get it. What a gift for them to learn those principles at a young age.

You can consider letting them earn money by doing tasks around the house if they don’t already get an allowance. Other fun ideas would be selling lemonade in the front yard, pet sitting for neighbors or friends, mowing lawns, raking leaves, etc. Or pick up a book about teaching kids how to handle money for other ideas on things they can do to contribute financially to their own or family goals. Just be sure to let them keep some of the money for something fun now. Otherwise, they may lose motivation if it all has to go into long-term savings.

19. Let Kids Decide How to Spend Their Money

Another fun learning lesson would be to let them keep the money they saved separate from the family funds when you’re traveling. Take time to talk before the trip about what they’d like to use it for. You can suggest that they use it for souvenirs to bring home or to buy a treat like ice cream or something for the family while on the road. Or maybe they’ll see someone in need during your travels and decide to donate to a cause that would help them. More lessons can be learned about unselfishness and thinking of others too.

Now you have all these creative ways to save money for travel or other treats. It’s time to start your savings account and get busy stashing away your extra cash. If you want to get even more serious about saving, there are tons of books (like the one above). You can also find articles out there with more ways to save. Just think how exciting it will be to watch your bank account grow. Soon you’ll be hitting the road on your next adventure.

Booking your trip? Here are some of the resources I use myself:

-Book great deals on flights with Cheap-o-Air

-Discover cool lodging with Booking.com

-Find the best prices and perks for cruises at CruiseDirect.com

-Reserve your vacation home rental with VRBO

-Book your car rental with RentalCars.com

-Buy your travel insurance with InsureMyTrip

-Book unique travel tours with Get Your Guide and Viator

-Find delicious culinary experiences with EatWith

-Find even more of my favorite travel resources here.

When you use these links I earn a small commission, at no extra cost to you. This helps me pay the bills and allows me to continue to create and share free tips and advice to help you travel better. As an Amazon Associate I earn from qualifying purchases.

One More Bonus Tip

If you have plans to visit any of the USA National Parks here are several other ideas for creative ways to save money while you’re traveling to those beautiful places.

How do you plan to start saving and what are you saving for next? What’s the hardest part of saving for you?